What goes into a great startup pitch deck?

That’s the question many founders ask when they’re about to raise capital for their startups. The best approach for creating a compelling pitch deck for a startup has been discussed by many VCs and successful founders over the years, and naturally there are plenty of opinions, ranging from what you should include in your presentation to which slide goes where.

Here, we’ll focus on proven ways to make your startup deck memorable.

These strategies and ideas used by successful companies can help you create a pitch that will leave investors itching to become part of your business. Let’s get to it…

BONUS: We’ve launched the Mobile Midas Touch: A list of the world’s top mobile investors. Download it for free now to see who’s who in the mobile market.

Customize Your Pitch To The Investors

Like a nice suit, the best startup pitches are tailored.

To make sure your pitch is cut just right, spend time researching your audience. In doing so, you’ll gain better insight into potential investors’ motives and the kinds of businesses they’re looking for. Reid Hoffman, co-founder of LinkedIn, once gave this exact advice to founders looking to raise capital in a blog post where he breaks down the deck he used to raise LinkedIn’s series B:

“Research prospective investors thoroughly. What kinds of businesses are they looking at? What model/criteria/triggers do they use to judge whether a project will be successful or not?”

Some investors value the technology more than the team; some investors are just looking for clear indications that your idea is going to work. Thankfully, in today’s climate, it’s easier than ever to gauge what investors want based on their tweets, LinkedIn profiles, websites and blogs.

Start Strong

The beginning of your presentation can make or break you. Within the first few minutes—maybe even seconds—potential investors begin to determine whether you’re someone they want to invest in or do business with long-term.

Before you develop a memorable pitch, you need to understand the oldest and lowest part of the brain: the limbic cortex, or what many professionals call the “lizard brain,” “crocodile brain” or “dinosaur brain.” It’s the part of the brain that helps us determine immediately whether something is dangerous or relevant, and how we should react to something new. It’s our first line of defence and controls our fight-or-flight response.

The croc brain is concerned with two things: Is it dangerous, and is it novel?

Anything dangerous—an idea that feels high-risk, counter to the investor’s thoughts, desperate or nervous—and the croc brain responds with rejection. If your pitch isn’t new or novel, the croc brain signals to the rest of the brain that it knows this information and can ignore it.

If your pitch is not able to make it past an investor’s croc brain, the presentation will likely fall flat. So how do you make it through the croc brain?

Showcase The Problem And The Solution

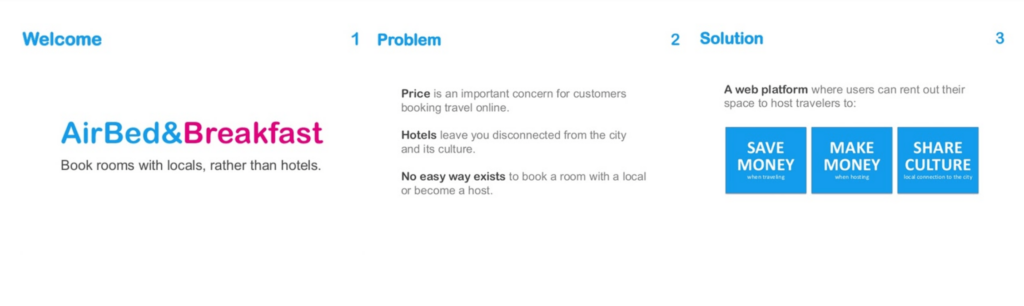

Take a look at these three slides from the first Airbnb deck:

The first slide breaks through the dino brain by sharing a novel idea:

Book rooms with locals, rather than hotels.

Paul Graham, founder of YCombinator, once wrote:

Before they (investors) can judge whether you’ve built a good x, they have to understand what kind of x you’ve built. They will get very frustrated if instead of telling them what you do, you make them sit through some kind of preamble.

That’s why you make it clear what you do in the very first slide.

When Airbnb launched in 2008, the concept of the sharing economy was still very new. Their idea was risky, but through compelling storytelling and a clear value proposition, they captured the attention of investors within a few short slides.

When pitching, the Airbnb team immediately addressed some of the concerns that an investor could have with their business model. The second slide explains why someone would book with Airbnb and not their biggest competitor (the hotel industry) and reveals the gap in the market. The third slide communicates the how behind their product and in simple language highlights the benefits for both parties involved in a transaction.

The transition from problem to solution is a staple in startup decks. It allows you to quickly highlight the pain points you’re solving for your customers and to address the concerns of potential investors. But problem-solution is also a format that investors see over and over, so it’s important to tell your story in a way that will quickly get your audience on board.

Share Facts & Graphs That Demonstrate Traction

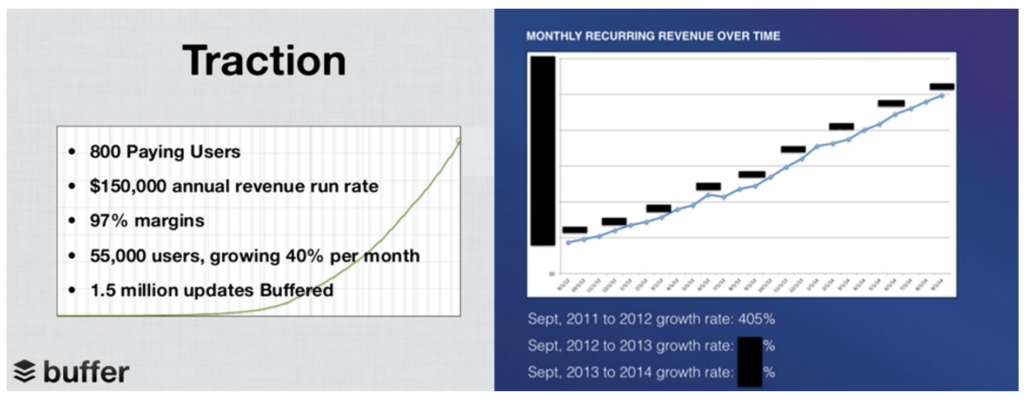

The slides above are from the pitch decks of Buffer and MixPanel, two marketing software companies that have raised millions of dollars and become industry icons.

These two slides show the importance of highlighting progress. Investors want to know that you can execute toward a plan and that you’re moving in the right direction. Ideally, they want to see exponential growth in your key metrics. For some startups, this might be the amount of time customers spend in the app; for others, it’s the number of paying users. Identify the metrics you feel are most important to your business and show your investors how you’re moving the needle.

Paint A Clear & Promising Picture Of The Future

LinkedIn’s Reid Hoffman once described the importance of showing the future to investors:

In order to believe that LinkedIn was a good investment, our investors would need to believe that there was a broad trend of moving from directories to networks (1.0 to 2.0), that networks could become hugely valuable, and that a LinkedIn people search application on a network would be a valuable asset.

It’s your job to paint a picture that’s bigger than what you have today. Show investors what the future will look like because of their investment. The most effective way to project the future is to communicate insights or stats about existing trends. Highlight information from industry reports that isn’t common knowledge, or reveal an insight you learned while building your product.

Sell the future—after all, the future is what investors are really buying into.

Conclusion

Raising capital isn’t as easy as the constant stream of TechCrunch headlines might make it sound. It takes a lot of late nights, pitch revisions, email followups and rejections.

The above tips will vastly improve your pitch, but the best way to create a quality deck is to ensure you have a quality product. Build something that people want, and remember that a demo does more than a PowerPoint. We’ve assisted plenty of startups looking to launch MVPs, arming them with the prototypes and resources they need to pitch their ideas.

If you’re interested in learning more about how we can help, get in touch today—we’d love to hear from you.